1. Inheritance Rights for Foreigners

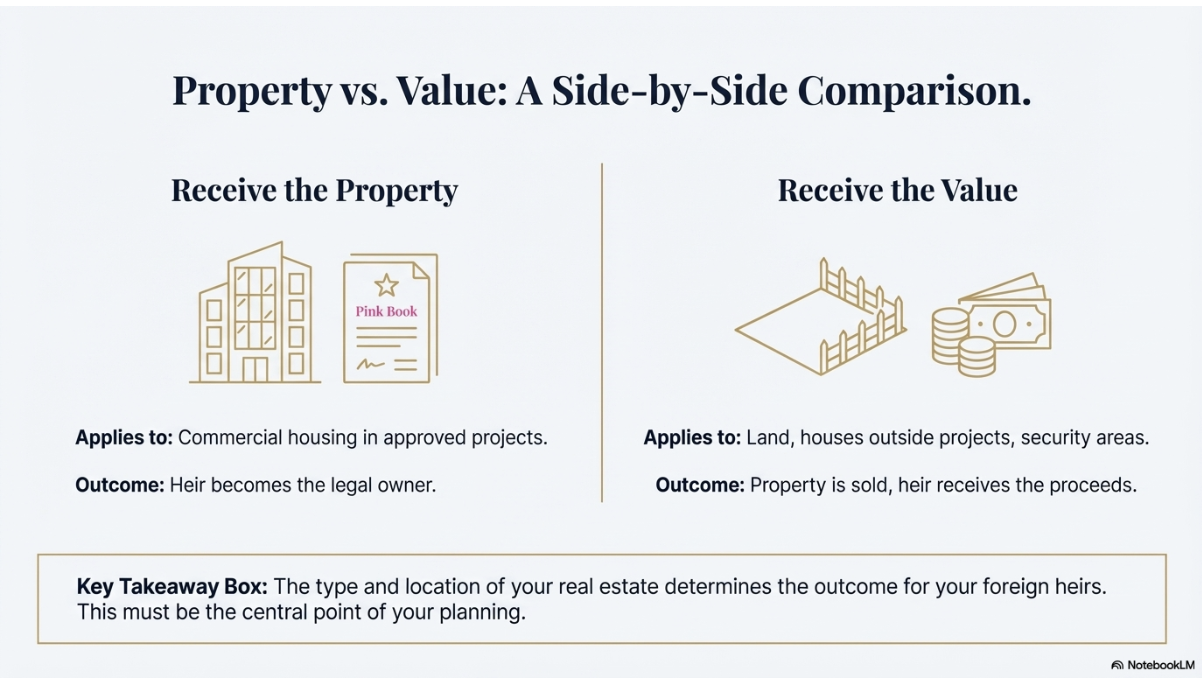

Under Vietnamese law, foreigners have equal rights to inherit assets via Wills or by law. However, regarding Real Estate, there is a clear distinction between receiving the “property in-kind” vs. receiving the “value.”

Receiving the Property (Ownership Title)

Foreigners can inherit and hold the title (Pink Book) if the asset is commercial housing (apartments, individual houses) within investment projects permitted for foreign ownership.

Receiving the Value Only

If the inheritance consists of land plots or houses outside of projects, or properties in national defense and security areas:

- Foreigners cannot be issued the Certificate of Land Use Rights.

- Solution: They are entitled to the value of the inheritance only (meaning the property must be sold/transferred, and the foreigner receives the proceeds in cash).

2. Procedures for Making a Legal Will in Vietnam

To prevent future disputes, creating a Will must strictly adhere to legal forms and content.

- Form of Will: It is highly recommended to make a Written Will that is notarized or certified. While oral wills are permitted in life-threatening emergencies, they carry high legal risks.

- Language: The law does not mandate the Will to be in Vietnamese. However, for ease of probate and execution in Vietnam, foreigners should draft a Bilingual Will (Vietnamese – English) or have a notarized translation.

- Conditions for Validity:

- The testator must be of sound mind and clear consciousness while making the Will.

- Not subject to deception, threats, or coercion.

- The content does not violate legal prohibitions or social ethics.

3. Inheritance Taxes and Fees

When receiving inheritance in Vietnam, foreigners are subject to tax obligations:

- Personal Income Tax (PIT): A flat rate of 10% applies to inheritance (real estate, securities, capital contribution, etc.) exceeding 10 million VND in value.

- Registration Fee: If the heir is eligible to title the property (house, car), they must pay a registration fee (typically 0.5% for real estate) upon transferring the title, unless eligible for specific exemptions.

Need Legal Advice on Wills & Inheritance?

Drafting a Will that complies with both Vietnamese law and the laws of your home country is complex. Whether you need to draft a bilingual Will or handle probate procedures for an estate in Vietnam, contact us for professional assistance:

📞 Contact DHH Law Firm Today

🏢 Main Office: 2nd Floor, 829 Huynh Tan Phat Street, Phu Thuan Ward, Ho Chi Minh City, Vietnam

📞 Hotline:

+84 89 9352 777 (Vietnamese)

+84 89 9351 777 (English)

🌐 Website: www.dhhlawfirm.vn

📧 Email: contact@dhhlawfirm.vn

✨ DHH Law Firm – Your trusted legal partner for family and foreign-related civil procedures in Vietnam.