Why Capital Contribution & Share Purchase in Vietnam Are Legally Risky for Foreign Investors?

Vietnam is an attractive destination for foreign direct investment, but capital contribution and share purchase transactions remain one of the most misunderstood and legally sensitive entry routes.

Many foreign investors assume that acquiring shares in an existing Vietnamese company is a “simple” alternative to setting up a new entity. In practice, this assumption leads to costly legal mistakes, regulatory delays, and even forced unwinding of transactions.

From a consulting lawyer’s perspective, the real challenge is not paperwork — it is structuring the transaction correctly under Vietnam’s investment and enterprise laws.

Common Legal Mistakes Foreign Investors Make

1. Assuming Capital Contribution Does Not Require Investment Approval

One of the most frequent errors is believing that capital contribution or share purchase automatically bypasses investment licensing.

2. Ignoring Foreign Ownership Caps and Conditional Sectors

Vietnam applies foreign ownership restrictions in many industries.

3. Treating Share Purchase as a Purely Corporate Transaction

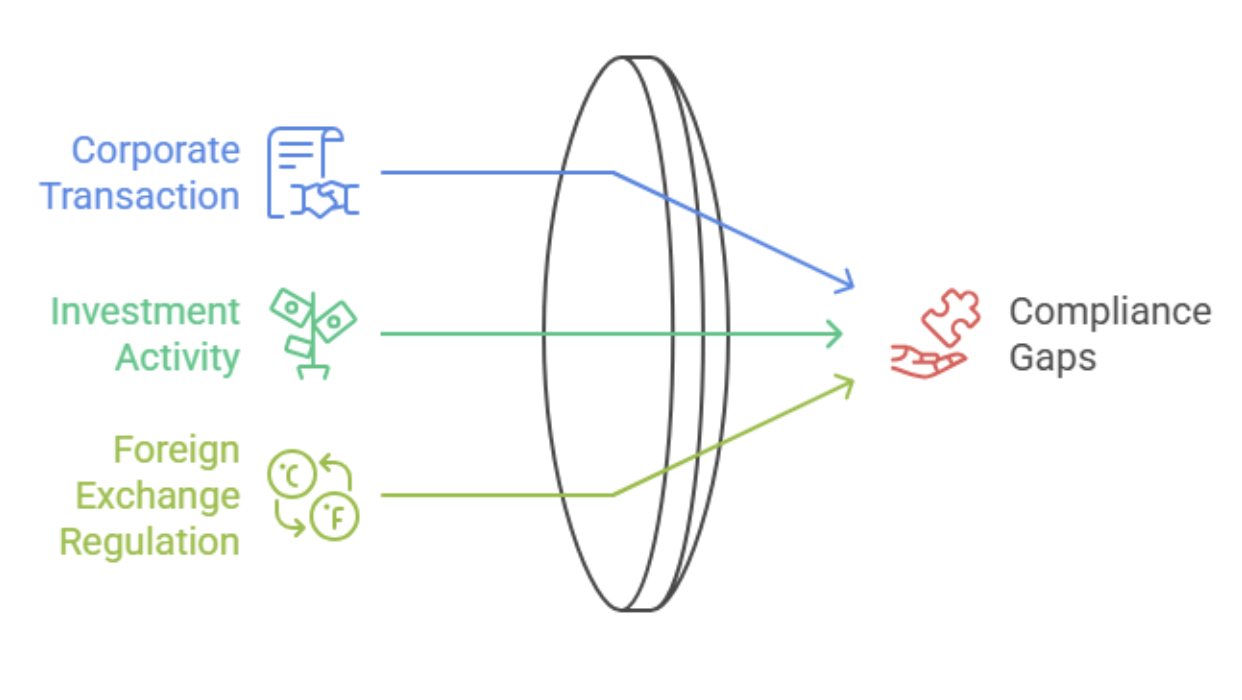

Foreign investors often approach share acquisitions as a corporate or M&A deal only, without considering investment law implications. In Vietnam, share purchase by a foreign investor is simultaneously:

- A corporate transaction

- An investment activity

- A foreign exchange–regulated transaction

Missing any of these layers leads to compliance gaps, especially in:

- Capital contribution accounts

- Timing of fund remittance

- Post-transaction reporting

4. Incorrect Capital Contribution Method and Timing

Vietnam law strictly regulates:

- The currency used for capital contribution

- The bank account through which capital must flow

- The timeline for completing capital contribution after approval

Common mistakes include:

- Transferring funds to the wrong bank account

- Missing statutory contribution deadlines

- Mixing loan funds with equity capital

These errors can result in:

- Inability to record ownership change

- Foreign exchange violations

- Tax and repatriation risks

5. Overlooking Post-Transaction Compliance Obligations

Completing the capital contribution or share purchase is not the end of the legal process.

Foreign-invested companies must update:

- Enterprise Registration Certificate (ERC)

- Investment Registration Certificate (IRC), if applicable

- Shareholder registers and internal governance documents

- Tax and foreign exchange filings

Investors who neglect post-closing compliance often face difficulties in:

- Profit repatriation

- Future capital increases

- Exit transactions

Why Legal Consulting Matters More Than Administrative Execution?

Many service providers focus on document filing and procedural steps. However, foreign investors need more than administrative assistance.

At DHH LAW FIRM, we approach capital contribution and share purchase as a strategic legal consulting exercise, focusing on:

- Optimal investment structure

- Risk prevention, not risk correction

- Long-term compliance and exit readiness

A consulting lawyer’s role is to anticipate legal bottlenecks, align the transaction with business objectives, and protect the investor’s position under Vietnamese law.

📞 Contact DHH Law Firm Today

Planning to contribute capital or purchase shares in a Vietnamese company?

Before signing any agreement or transferring funds, consult with experienced investment lawyers.

👉 Contact DHH LAW FIRM for a strategic legal consultation tailored to foreign investors entering or expanding in Vietnam.

🏢 Main Office: 2nd Floor, 829 Huynh Tan Phat Street, Phu Thuan Ward, Ho Chi Minh City, Vietnam

📞 Hotline: +84 89 9352 777 (VN) | +84 89 9351 777 (ENG)

🌐 Website: www.dhhlawfirm.vn

📧 Email: contact@dhhlawfirm.vn

✨ DHH Law Firm – Your trusted legal partner for family and foreign-related civil procedures in Vietnam.